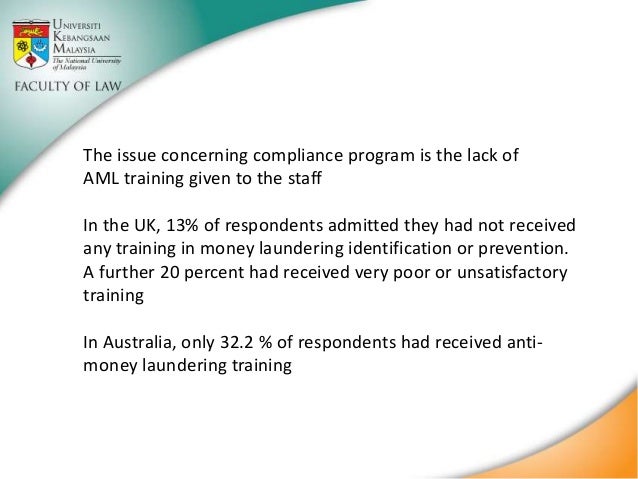

Anti Money Laundering Policy Template Uk Free. This section details some of the laws and guidance about anti-money laundering in the UK. Generally, money laundering occurs in three stages.

Anti-money laundering is the process of financial institutions and other business entities using in-house (sometimes assisted by external parties - more on this to come) methods to address the risks posed by Trade-Based Money Laundering.

FXOpen has developed internal Anti-Money Laundering and Counter-Terrorism Policy based on the risk assessment so the objectives of the AML/CFT Laws To help the government fight the funding of terrorism and money laundering activities, law requires all financial institutions to obtain, verify, and.

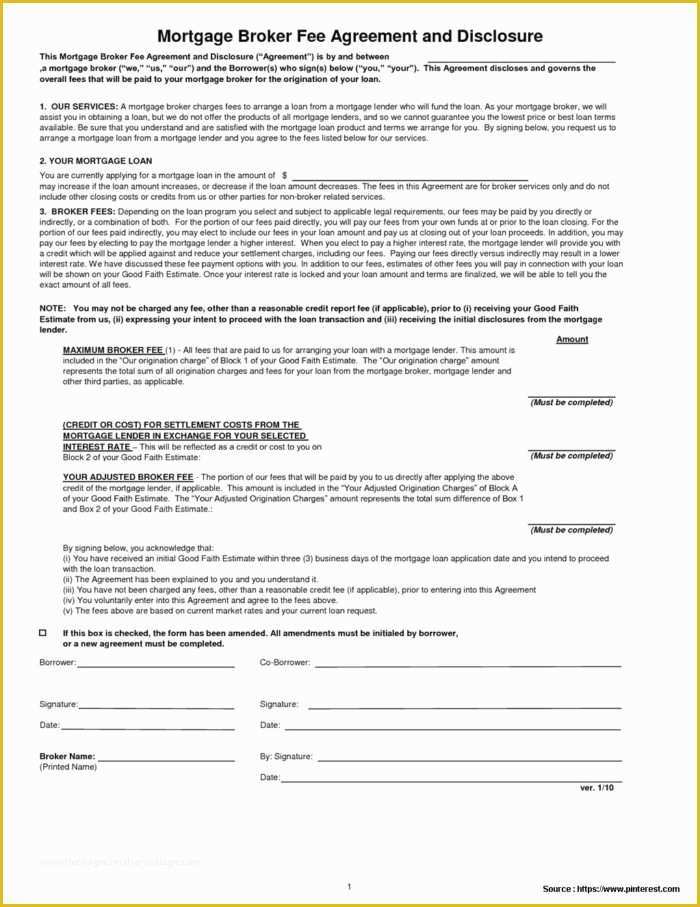

Anti-money laundering policy is a combination of measures used by a financial institution to stop the reintroduction of the proceeds of illegal activities. Meet anti-money laundering & KYC compliance requirements, perform AML anti-money laundering checks online and safeguard your customers. The UK is a full member of the Financial Action Task Force (FATF), the. when you suspect money laundering or terrorist financing. when you have doubts about a customer's identification information that you obtained A policy statement is a document that includes your anti-money laundering policy, controls and the procedures your business will take to prevent.