Anti Money Laundering Compliance Program Sample. An anti-money laundering compliance program is everything a company does relating to compliance: built-in internal operations, user-processing policies, accounts monitoring and detection, reporting of money laundering incidents. Regulations and laws require financial institutions to have.

Anti-money laundering software is used by companies to detect suspicious activities by persons or organizations who are trying to generate income through illegal actions.

An anti-money laundering program is a set of regulations and procedures that financial institutions follow to prevent and detect money laundering or terrorist financing activities.

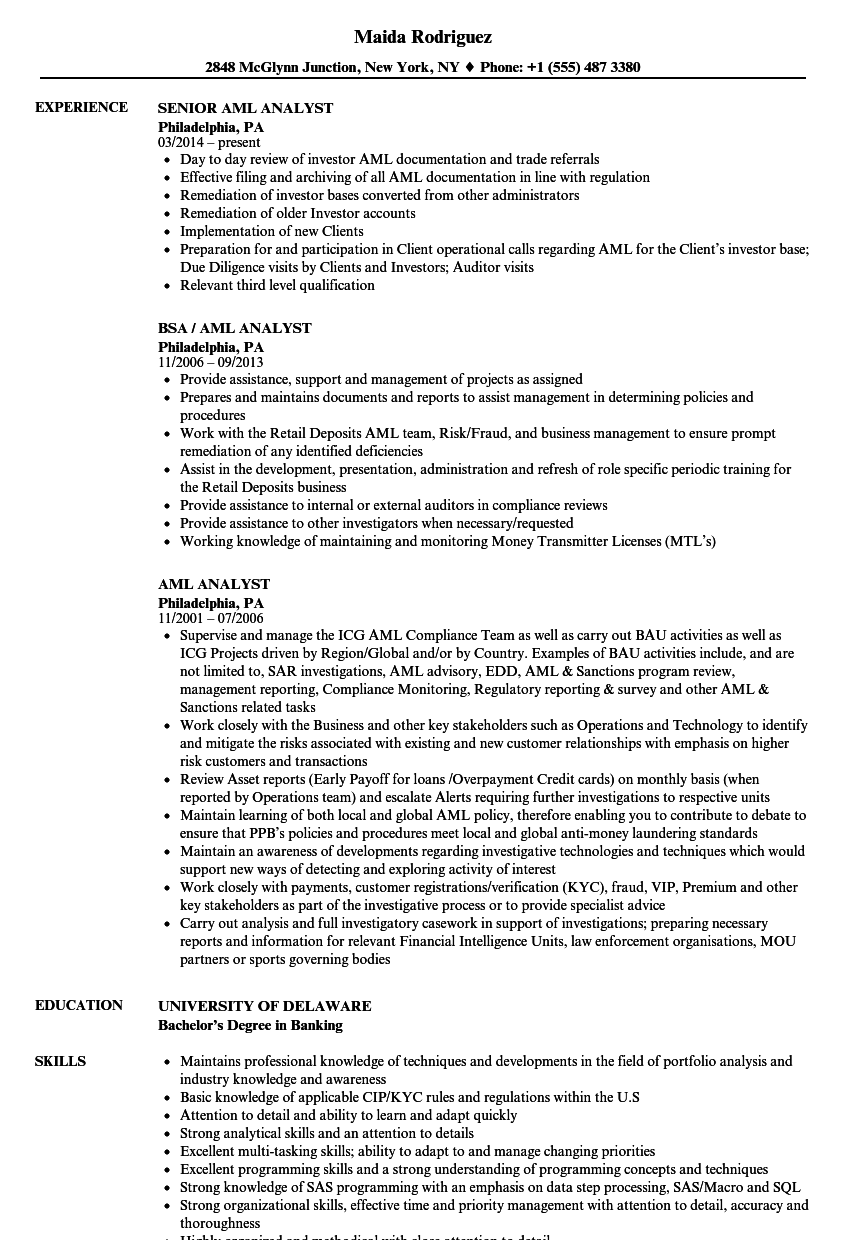

This software is used by compliance professionals to comply with regulations such as the Bank Secrecy Act and with. Anti-money laundering compliance is vital for obliged entities and being conversant with AML compliance regulations and industry prevalent The customer is screened against global watchlists, sanctions, and PEPs lists. Bachelor's degree, preferably in business, finance or accounting.