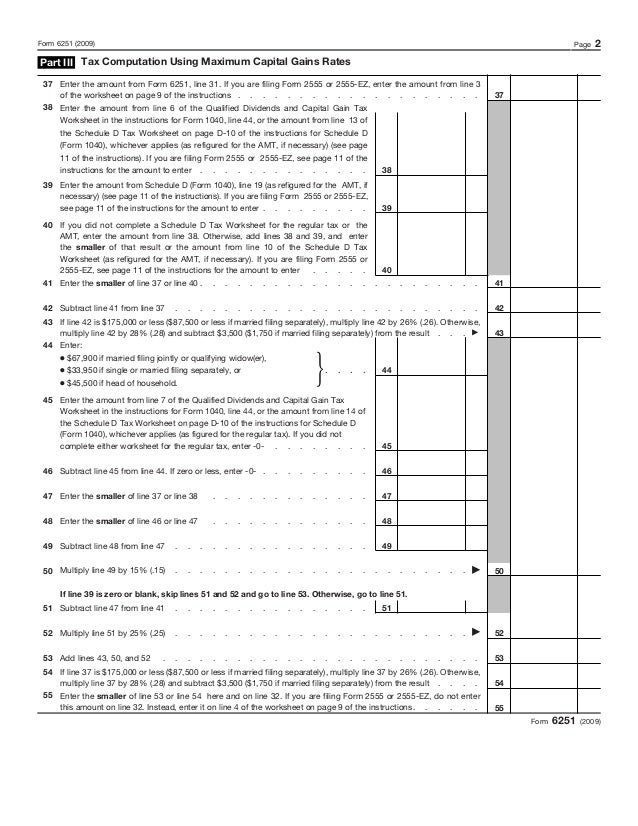

Amt Capital Gains Worksheet. How capital gains get treated under the AMT. Although the AMT has a simpler rate structure, it still incorporates some of the complexity of the regular tax Under a worksheet in which you calculate your AMT liability, you'll go through several calculations that effectively determine how much of your.

Alternative Minimum Tax (AMT), introduced for non-corporate taxpayers works on similar principles.

Worksheet will open in a new window.

Realizing a large capital gain Long-term gains (e.g., when you sell a home or other investments for a profit) are taxed at the same rate under both systems If you're close to the AMT threshold, it's good practice to do a multiyear projection to see which tax years pose the most risk for you and how you. Once you find your worksheet, click on pop-out icon or print icon to worksheet to print or download. This worksheet helps you calculate a capital gain or capital loss for each capital gains tax (CGT) asset or any other CGT event.