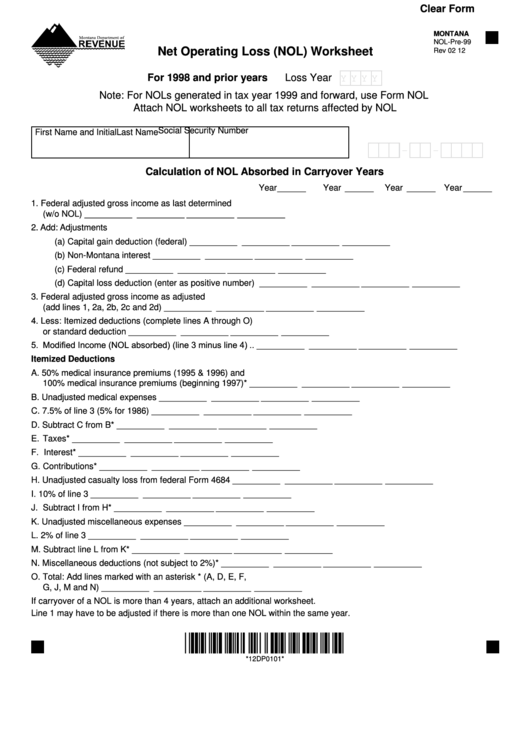

Alternative Tax Nol Worksheet. A net operating loss (NOL) is a loss taken in a period where a company's allowable tax deductions are greater than its taxable income. AMT NOL Calculation Worksheet - Free download as PDF File (.pdf), Text File (.txt) or read online for free.

The portion of such NOL that can be carried to each of the other tax years is the excess, if any, of the amount of such NOL over the sum of the taxable income for each of the prior tax.

While it is necessary to refigure your income tax, alternative minimum tax, and credits, do not refigure your self-employment tax and Additional Medicare Tax.

This loss can be carried forward in the future to set off future profits allowing the corporates to pay lesser tax than required. An NOL Tax Loss Carryforward (also called a Net Operating Loss NOL carryforward) is a mechanism firms can use to carry forward losses from prior years to offset future profits and therefore lower future income. A taxpayer calculating the alternative minimum tax amount must take the alternative tax net operating loss deduction.