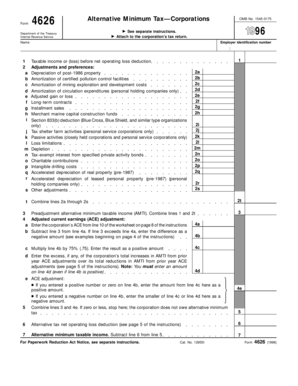

Alternative Minimum Tax Nol Worksheet. Although the AMT NOL computation normally begins with the regular tax NOL, there is no requirement that a regular tax NOL exist for there to be an AMT NOL or vice versa. Name: ID Number Documents Similar To AMT NOL Calculation Worksheet.

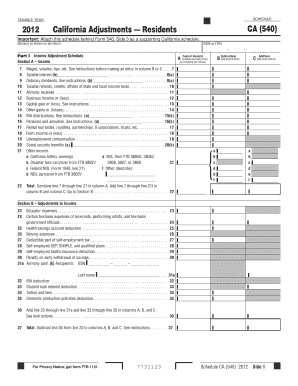

In some cases, it is easiest to refigure an item for AMT by completing a tax form or worksheet a second time using additional AMT instructions.

The alternative minimum tax has long been a thorn in the side of U.

It is computed the same as the NOL for regular tax purposes with two modifications. alternative minimum tax (AMT). a separate and parallel method of calculating income tax liability. The alternative minimum tax (AMT) is a tax imposed by the United States federal government in addition to the regular income tax for certain individuals, estates, and trusts. NOL deduction is the amount of NOL that You do not have to include the alternative minimum tax NOL computation.